Envisioning new product features

I led the research and design of a suite of new features to attract, engage and retain BBVA customers.

BBVA is a global bank with 56 million customers across Latin America, Europe, and the U.S.

The Challenge

In 2016, BBVA’s primary consumer acquisition channel was about to disappear.

Historically, companies using BBVA Payroll brought all their employees with them to BBVA – providing an influx of customers. But new legislation was about to give employees freedom to choose where to deposit their paychecks. BBVA’s value proposition for direct-deposit customers wasn’t compelling enough to attract new customers.

Our mission was to envision a set of products, services and digital features that would be valuable and differentiated for direct-deposit customers. Our goals included:

- Increase acquisition and retention

- Increase engagement and customer knowledge

- Enable independence from cash and branches around pay day

- Increase average balances held by employees

Our Impact

BBVA now has a differentiated, customer-centric value proposition which is rooted in features my team envisioned.

Acquisition: Whereas before this initiative, virtually all direct-deposit customers were acquired indirectly through their employers, now a majority of customers are acquired directly.

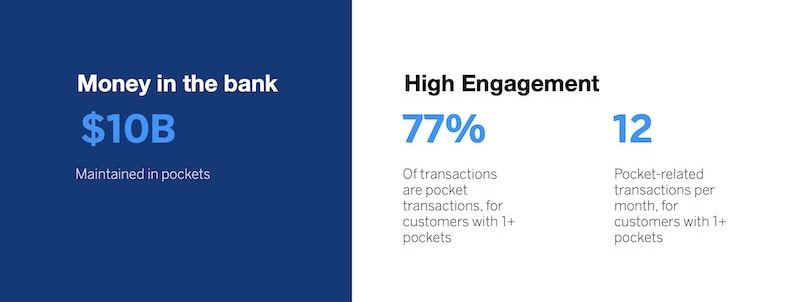

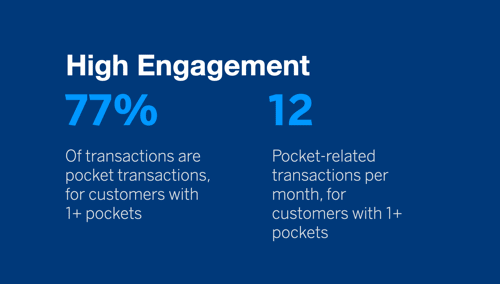

Engagement: Customers using Apartados are highly engaged, with 12 apartados-related transactions per month. Customers are also highly engaged with Goals and Calendar features.

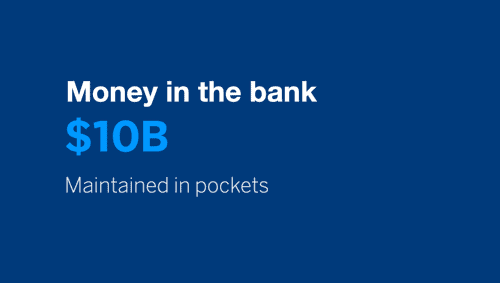

Balances: All BBVA customers (even those without direct deposit) now keep more money in the bank – $10B in Apartados.

Our Approach

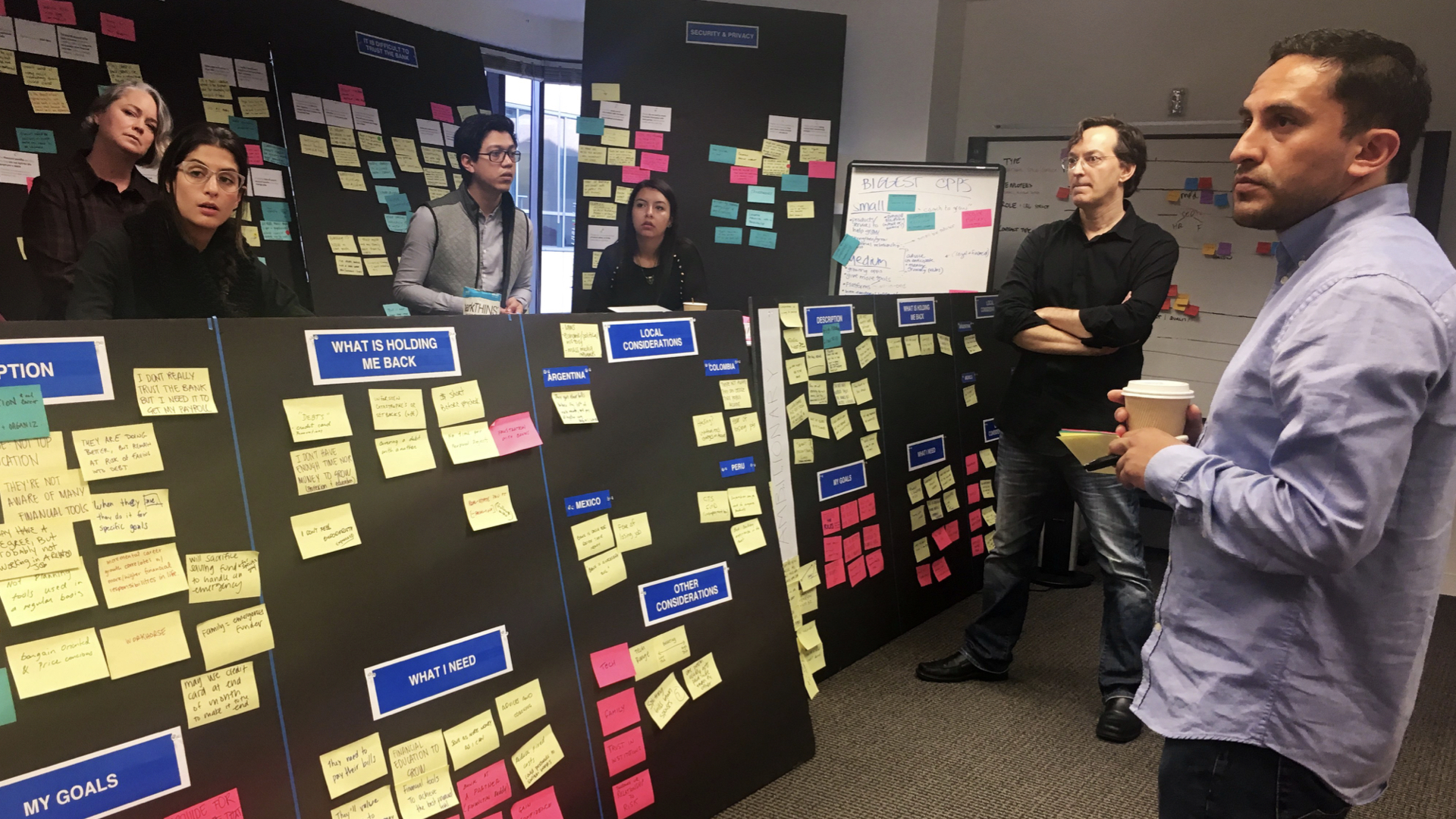

Understanding our customers

Of course we needed to begin by understanding customer needs, expectations, behaviors – along with the cultural contexts in Mexico, Argentina, Peru, and Colombia.

Building the team

An initial challenge was that BBVA didn’t have a researchers in Latin America. We were still ramping up BBVA’s design and research capabilities. To meet this challenge, I identified a research firm with deep experience and presence in Latin America, made the case to senior leadership for hiring them to conduct the research sessions for this project, and directed their work.

Our team interviewed 60+ employees at 50 companies across 4 countries.

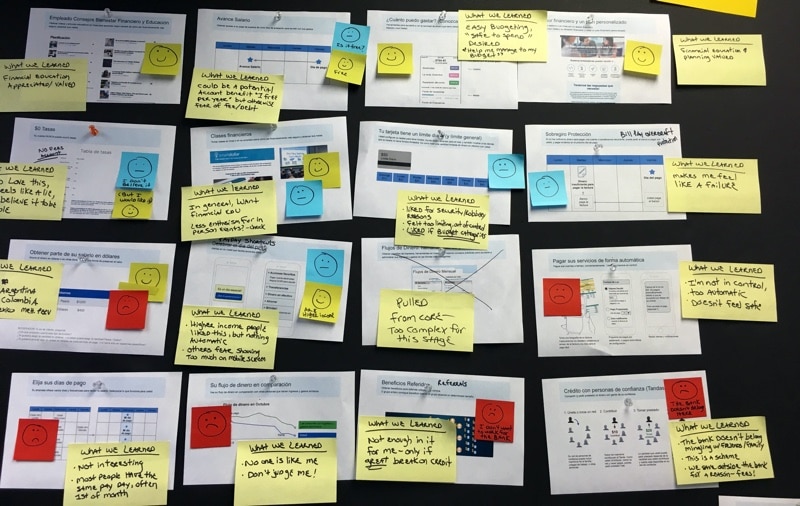

Facilitating insight synthesis

I facilitated workshops with the research, design, and product teams to synthesize research insights and develop our personas framework.

Key insights

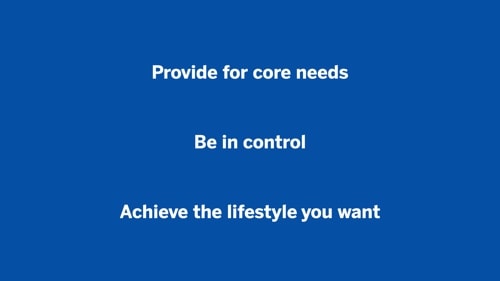

Shared hierarchy of goals

We found that all participants had a shared set of high-level needs. Ranging from functional to emotional to self-actualization, these needs would become the framework for our value proposition.

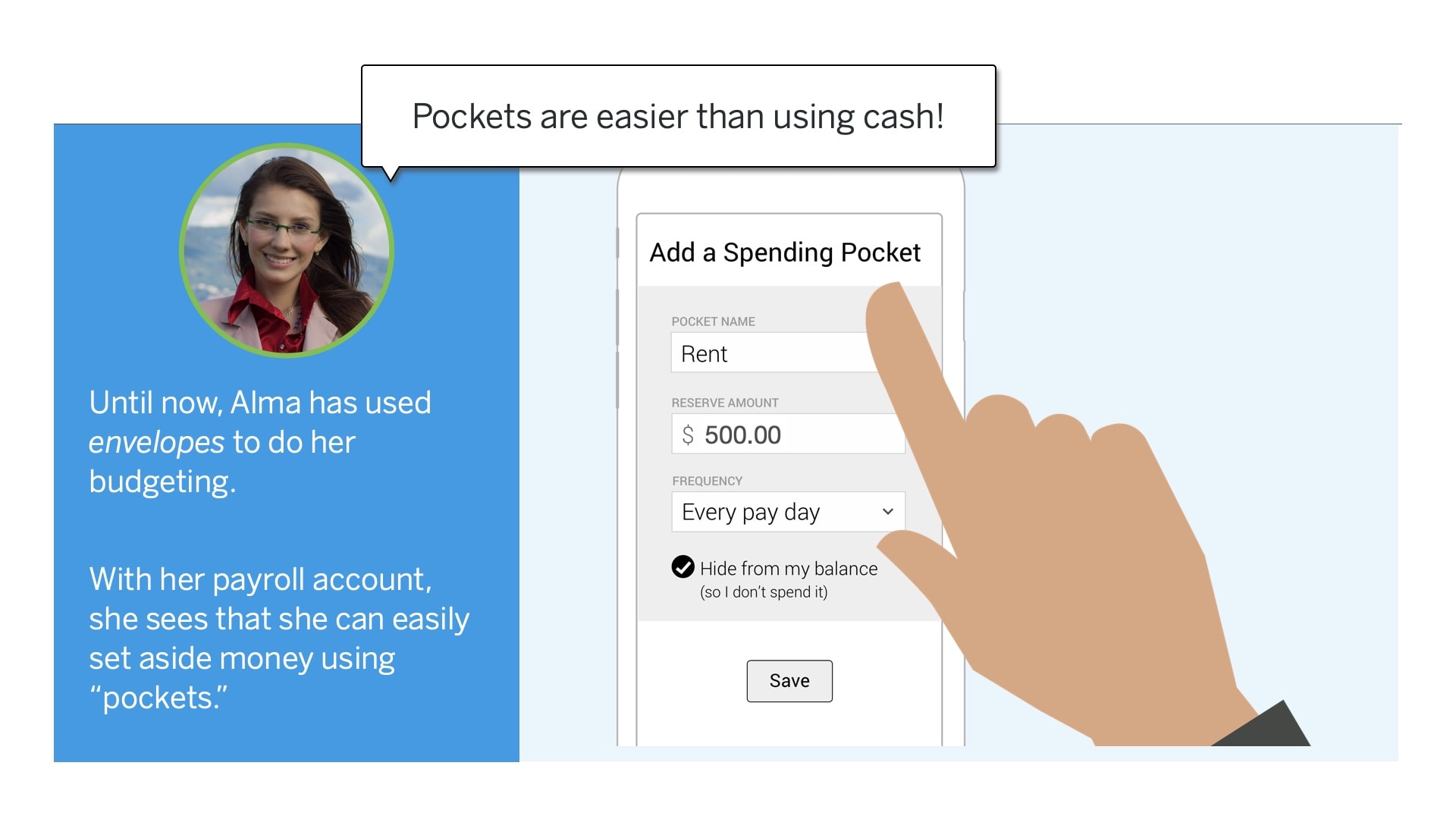

Customers need better tools for managing money

Many participants we interviewed showed us how they used envelopes or jars to managed their earnings, including “hiding” money from themselves (and others) so that it isn’t spent frivolously.

Banks didn’t yet provide simple tools for setting aside and organizing money. Participants were also wary of unexpected banking fees.

As a result of all these factors, many customers withdrew a large portion of paychecks on payday in order to manage with cash. This practice is dangerous, laborious (and bad business for the bank).

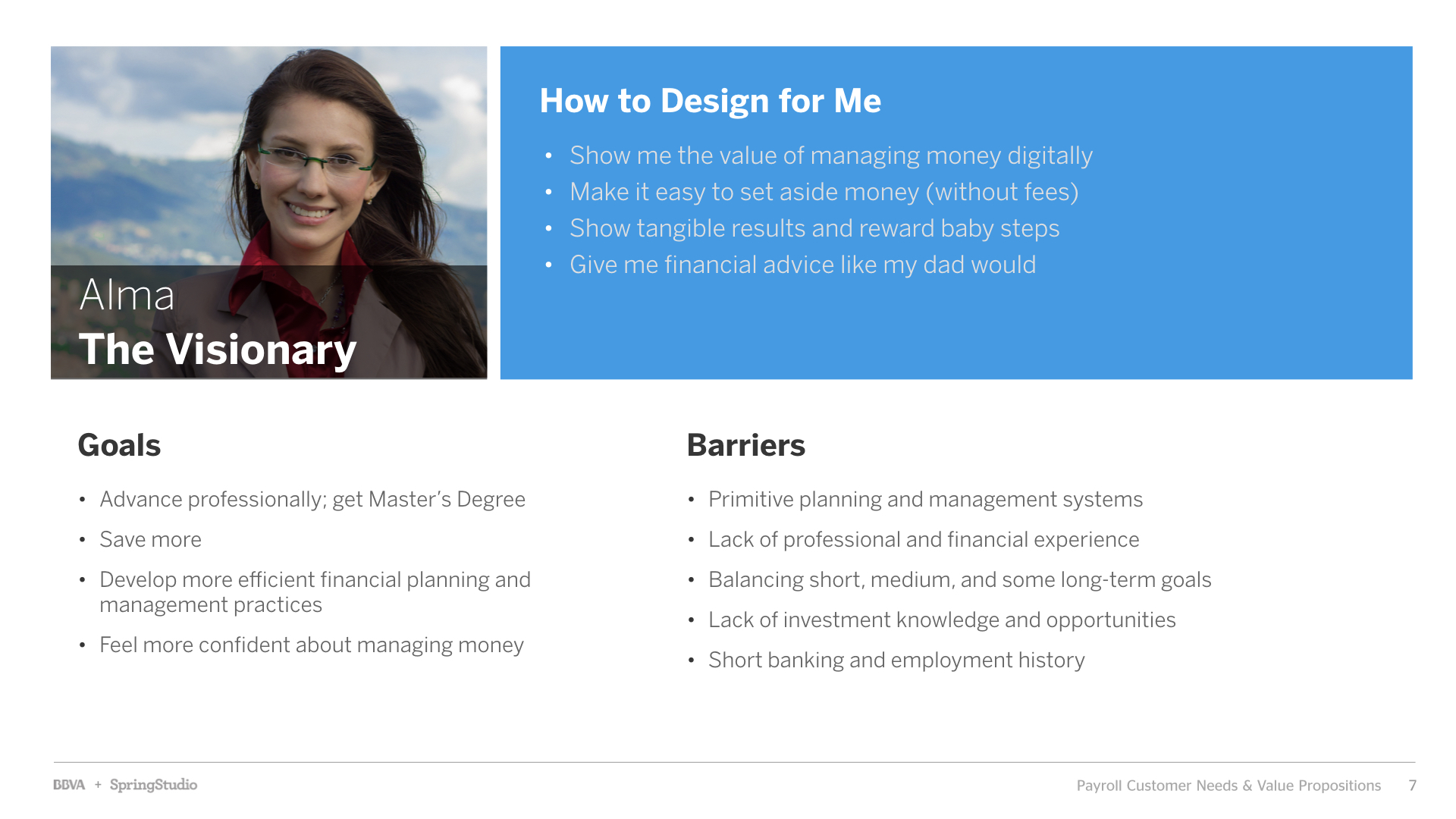

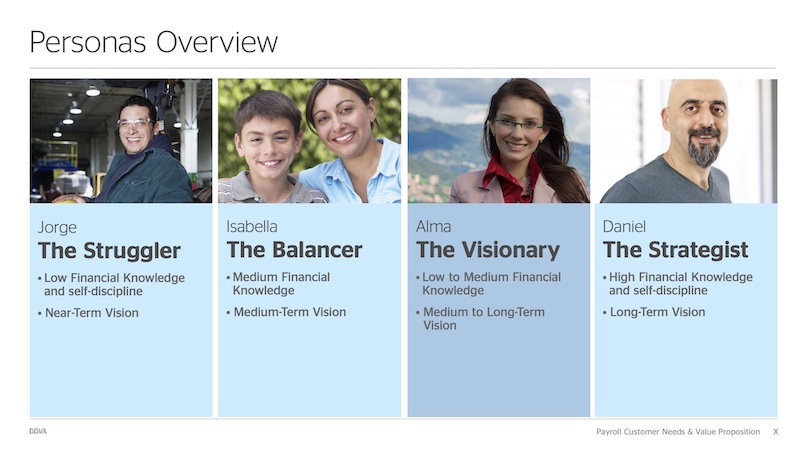

Developing personas

I led the team in the creation of research-based personas. We determined that the most useful differentiation was by varying levels of financial knowledge, financial self-discipline, and planning time-horizons

We used these personas throughout the product development process to guide and inspire us. I’m a big fan of using personas in design critiques and cross-functional workshops – as well as in scenario storytelling.

Testing high-level concepts early

We put very high-level conceptual sketches in front of customers to get early feedback on potential features. These tests helped us to identify which features might provide most value – and enabled us to discover underlying drivers, like the need to feel safe at ATMs.

Envisioning a North Star

Based on key insights from research and feedback on concepts,

we developed a high-level North Star vision.

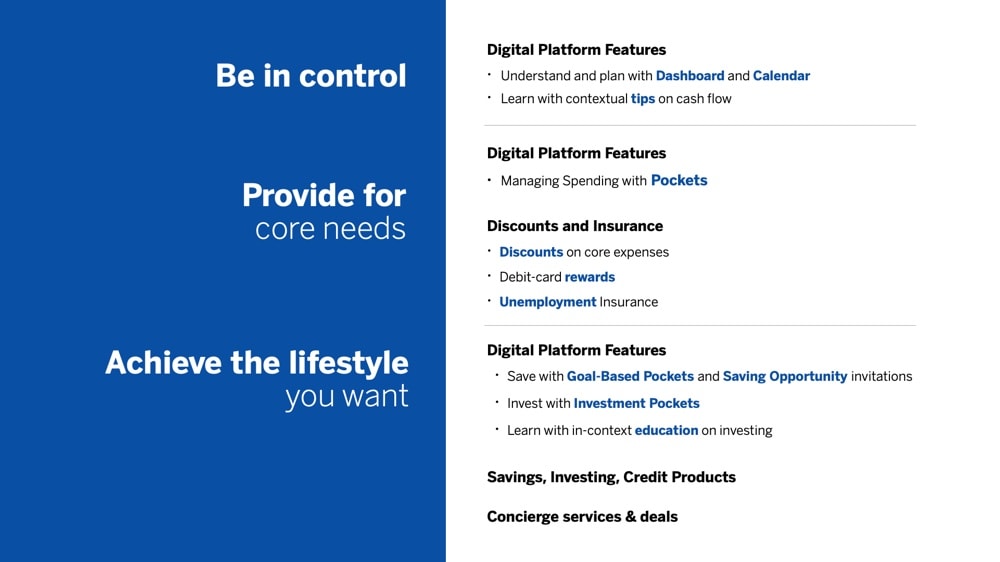

Crafting value prop pillars

We crafted our value proposition based on the shared hierarchy of needs we observed in our research.

Delivering value

To deliver value across these pillars, our North Star vision included digital tools and content, discounts, services, savings products, and more.

Socializing the vision

We told stories for each of our personas, that showed how the new suite of features and services empowered them.

Here’s a snippet of Alma’s story.

Getting to MVP

Prioritizing

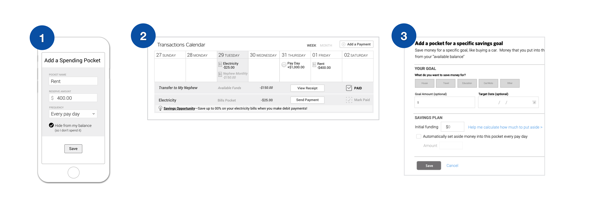

Based on customer value, business value, and feasibility of quick implementation, we identified top features for detailed design: Expense Pockets, Transactions Calendar, and Savings Goals.

Exploring differentiated models

For each of our prioritized features, we explored differentiated potential models to approach the North Star experience vision. For pockets, for example, would it be best for customers to have freedom to create multiple pockets – each for different types of expenses – or simply one “monthly expenses” pocket?

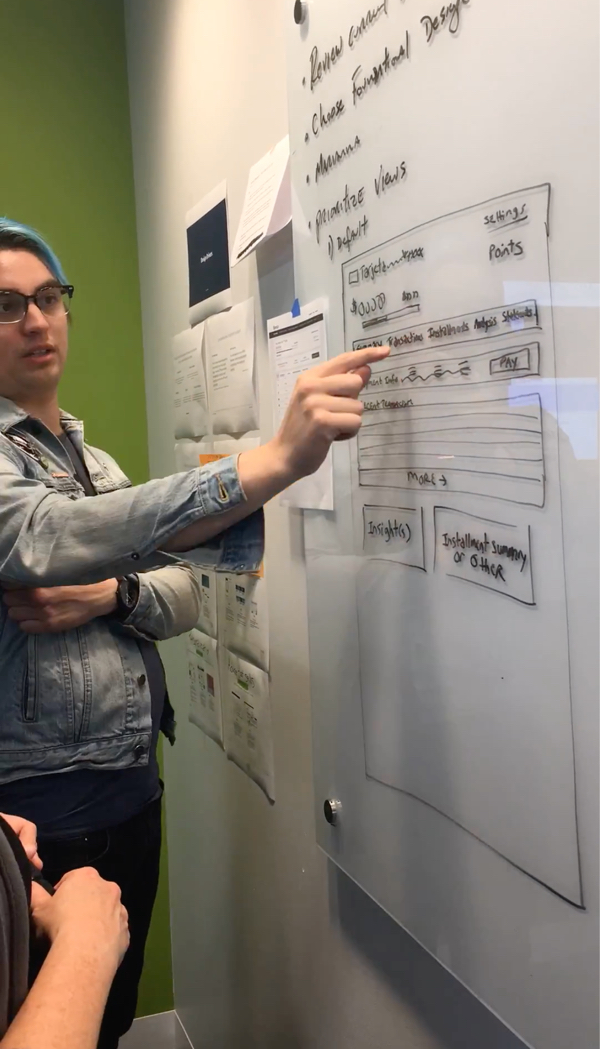

Collaborating and Critiquing

Collaborative sketching, workshopping, and critique from designers outside the core team pushed the team to innovate, simplify complexity, and align.

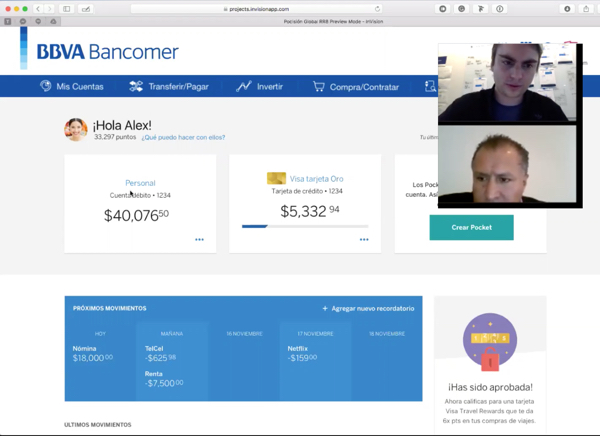

Prototyping and testing

We held standing research sessions every two weeks for customer feedback on our prototypes.

Learning and Refining

Based on testing data, we iterated on interaction, navigation, feature labels, and copy. We made further refinements to arrive at solutions which could be released in the short term.

BBVA was simultaneously undergoing a brand redesign and first-time creation of a design system. Our team collaborated with the design system team and influenced component behavior and styling.

Feature Walkthrough

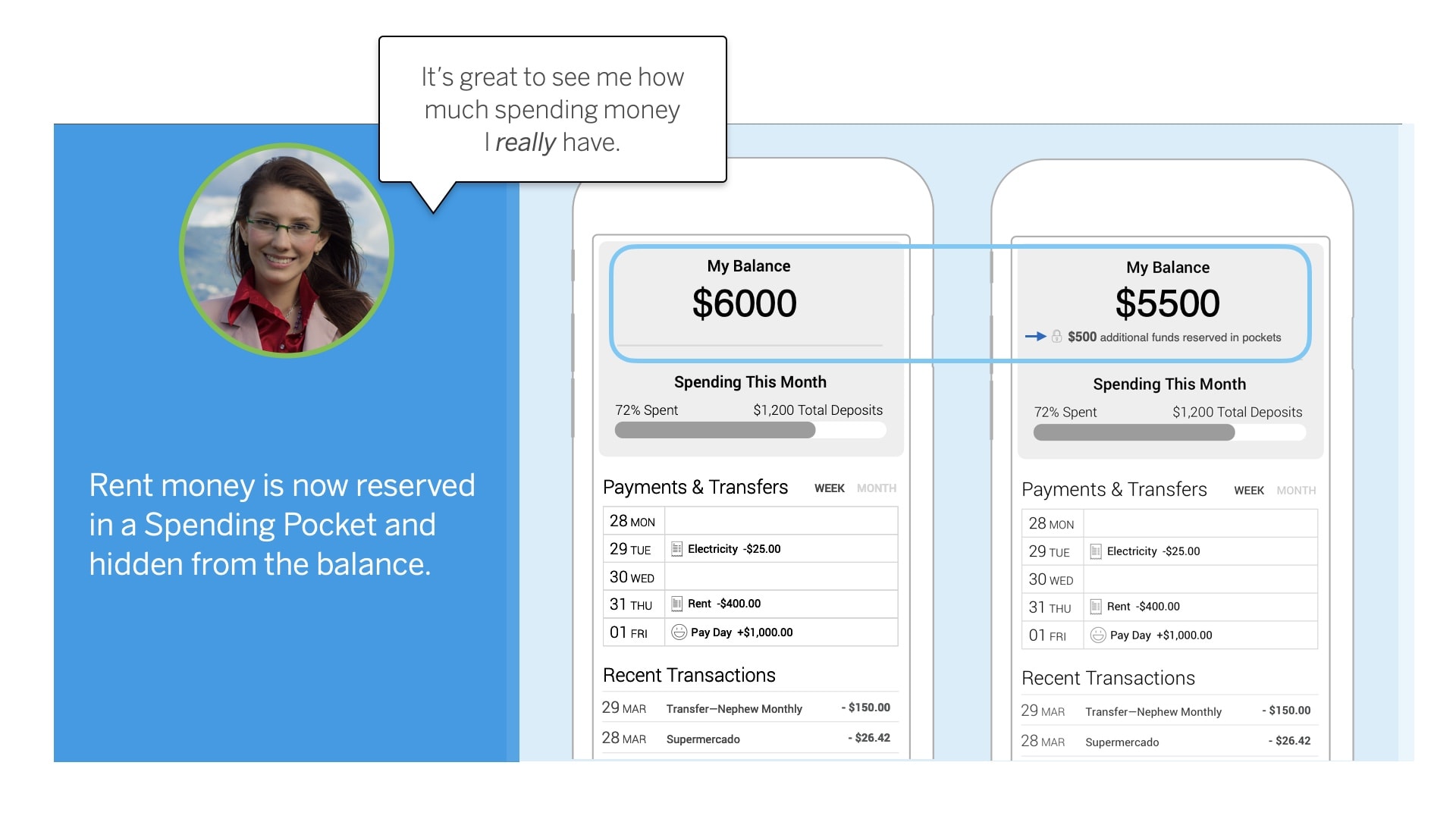

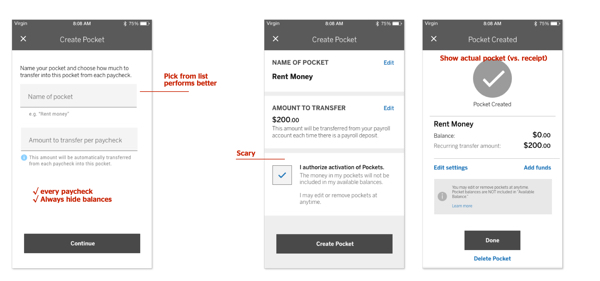

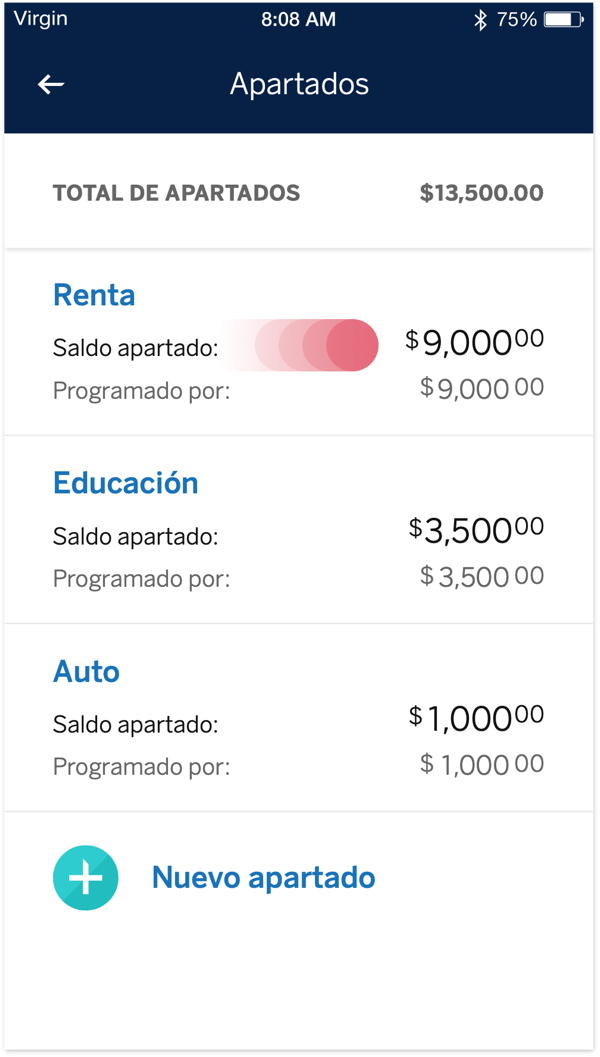

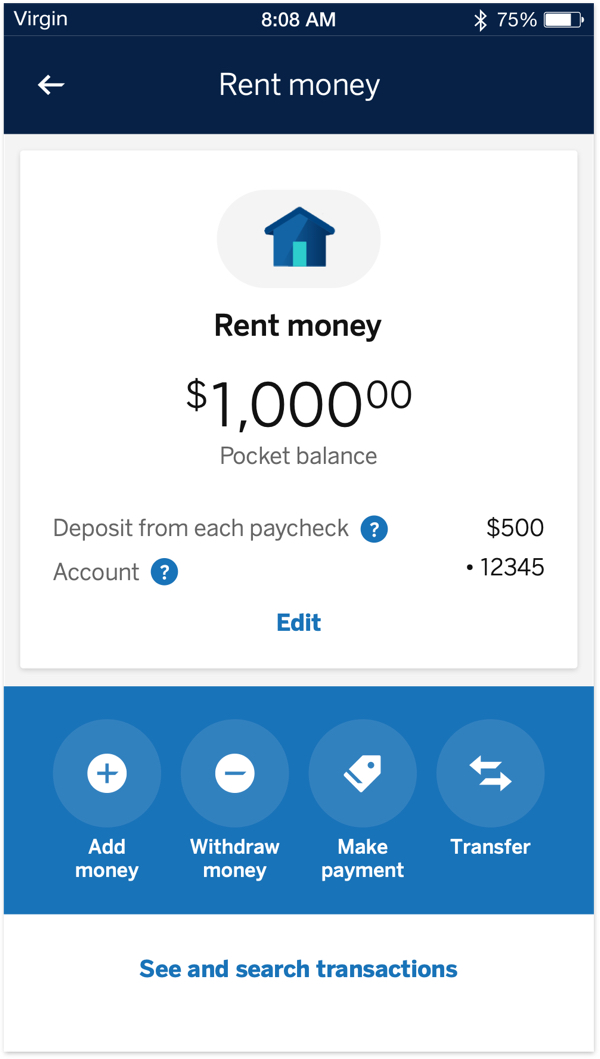

Set aside money for rent

Alma can set aside $500 for rent from her paycheck, by creating a “Rent money” Pocket (or Apartado in Spanish). She can choose a label, or create her own, then enter an amount to set aside.

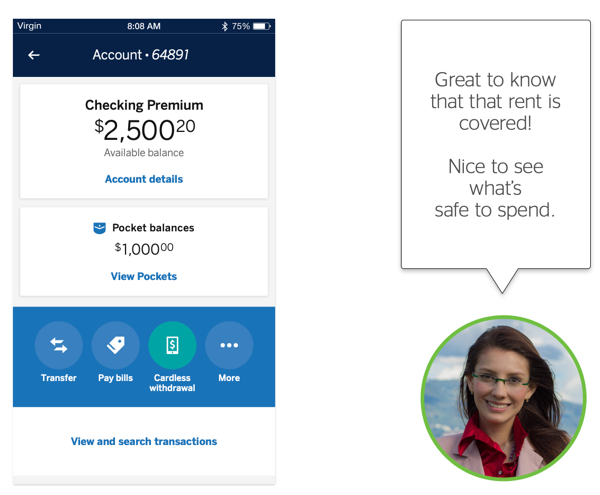

Know that rent is covered

With her rent money set aside, Alma’s available balance shows how much she can safely spend on other expenses.

Pay rent

Alma can pay rent using her “Rent money” pocket.

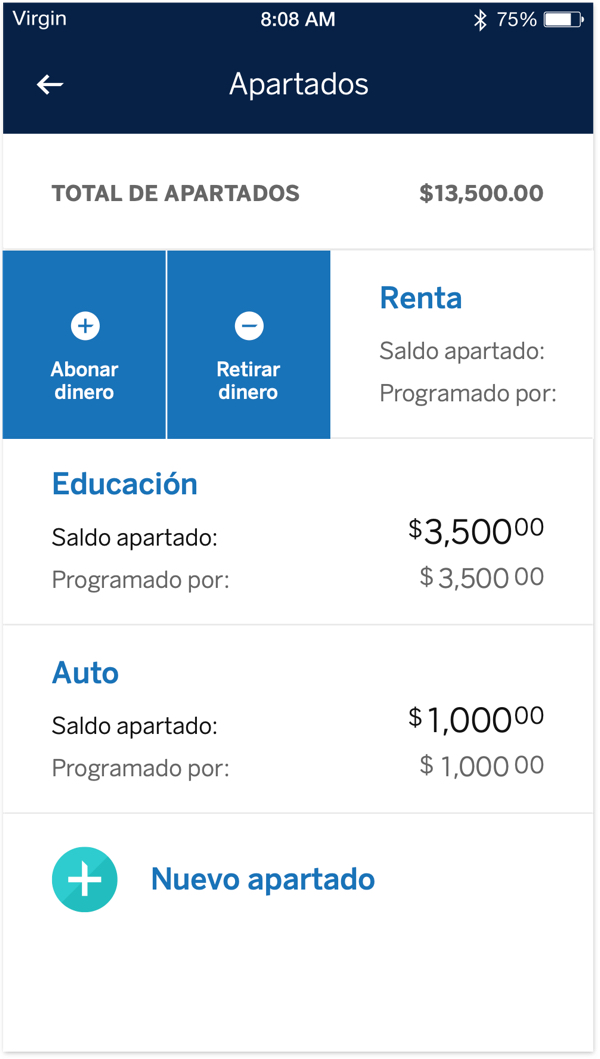

Manage Pockets

Alma can add or withdraw money from directly from the list of all Pockets. Or, she can manage, make payments, or transfer in the Pocket detail view.

Set a savings goal

Create a Goal (aka “Meta”) to save toward a specific goal like a vacation or an advanced degree. You can program deposits from an account to your Goals and track your progress. (Whereas Pockets was released in the Global mobile app, Metas was first released in Spain’s mobile app.)

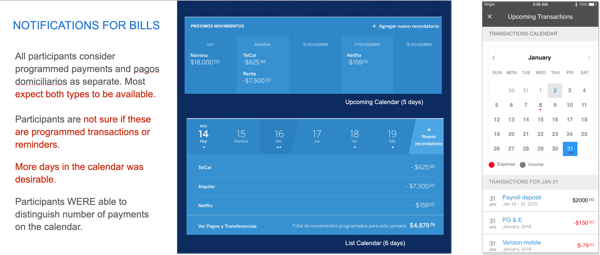

See upcoming income and expenses in a calendar

This familiar frameworks helps Alma feel in control when planning finances. (Whereas Pockets was released in the Global mobile app, Calendar view was first released in Spain’s mobile app.)

Impact

The features we created are empowering customers and driving business goals.

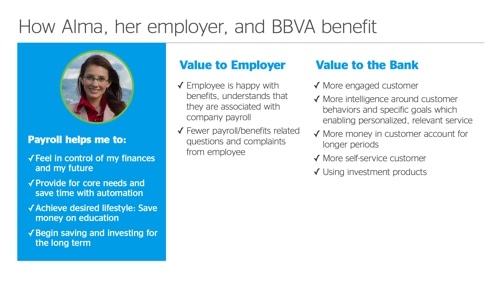

Customer benefits

Alma has simpler, more powerful and safe ways to plan, set aside money, and save money toward specific goals. This empowers her to:

- feel in control of her finances and her future

- provide for core needs

- achieve her desired lifestyle by saving for her education

- begin saving for the long term

- save time and effort

- reduce chance of losing cash or being robbed

Compelling value proposition

BBVA now has a differentiated, marketable value proposition which is rooted in features my team envisioned: Apartados (for setting aside money), Metas for saving toward goals, and Calendar view for feeling in control.

Apartados are featured prominently on the website and in the app store.

Whereas before this initiative, virtually all direct-deposit customers were acquired indirectly through their employers, now a majority of customers are acquired directly.

High engagement and customer intelligence

Customers using Apartados are highly engaged, with 12 apartados-related transactions per month. Customers are also highly engaged with Goals and Calendar features.

Engagement around specific expenses and goals provides data, that can be used to provide more personalized, relevant products and services.

Higher balances

Whereas many customers had been withdrawing their paychecks in cash, customers now keep more money in the bank – $10B in Pockets – a key business goal.

Reflections

Bonus successes

Some of the features we envisioned were so successful that the business decided to make them available to ALL customers, instead of limiting them to direct-deposit customers.

Apartados (Pockets) is a primary part of the overall value proposition for BBVA’s award-winning mobile app.

Opportunities

We would have benefitted from the opportunity to test variants for each of the digital features we created.

More info available for in-person presentation.