Driving design maturity

As a Design Director at this peer-to-peer lending marketplace, I led teams of product designers across three business units who were responsible for the experience of 15M+ consumers per year.

Highlights include transforming team culture, elevating team output, building the strategic value of design, and directing a myriad of projects.

Design Director • 2019-2020

Transforming team culture

When I joined LendingClub, two designers had just submitted their resignations and team morale was at an all-time low. I led the transformation of the culture to one of collaboration, alignment around a shared vision, continuous learning, and fun.

Growing diversity

I updated our hiring process to attract a diverse candidate pool, and use a more inclusive, objective interviewing process. Thanks in large part to our new process, I was fortunate enough to add two outstanding women of color to my team.

Championing collaboration

I initiated new collaboration practices like open design sessions, cross-functional workshopping, shared inspiration libraries, and pair design when possible. I led the creation of a large design studio space, and introduced online whiteboarding (before COVID).

Developing talent

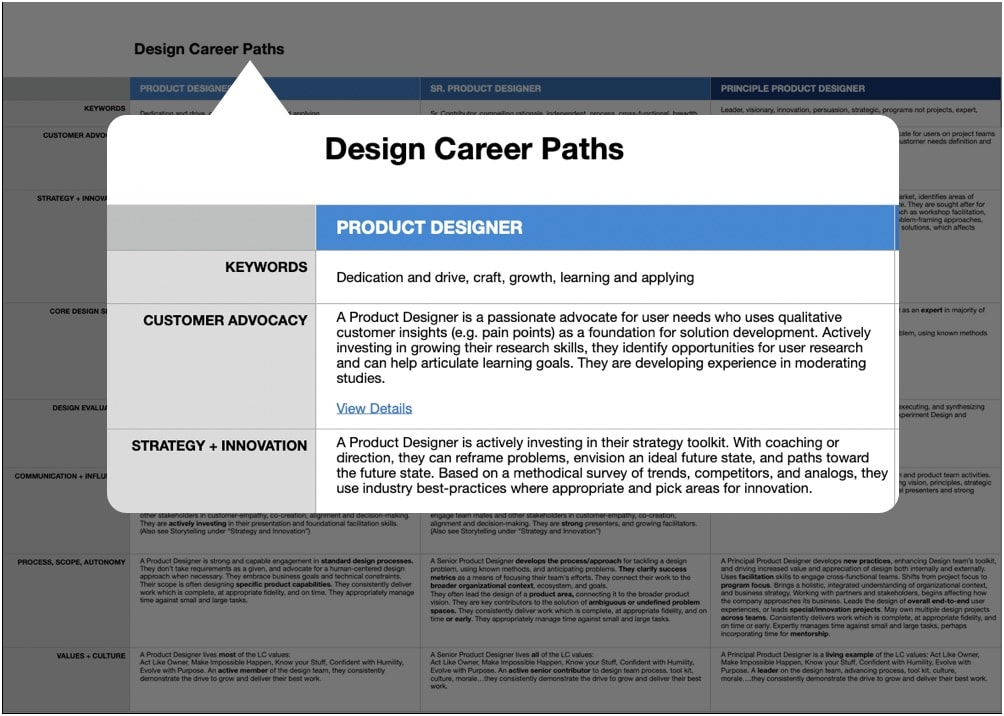

I care about the designers on my team, and their success. I enjoy helping them flesh out their skill sets and advance in their careers.

I got to know my team, clarify expectations and opportunities for advancement, and ensure aligned progress through key activities including:

- led skill and interest mapping activities

- established career paths

- facilitated goal setting for each designer, using a 30-60-90 day framework

Elevating craft and performance

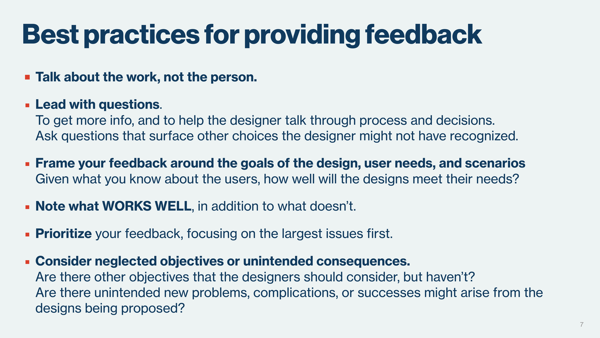

I empowered the team to be more strategic, ensuring that they experience goals, design principles, and defined high-level end-to-end north-star experience visions.

I fostered quality by improving the critique process to be more methodical and rigorous, by staying close to the work and providing regular feedback, insisting on accessibility reviews, frequent testing with customers, and by enabling designer pairing when possible.

Accelerating learning

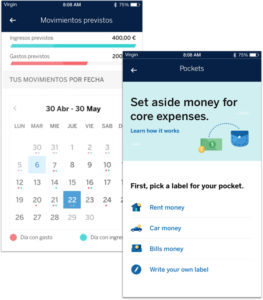

I introduced concept resonance testing and more robust prototyping to our process. This empowered the team to take a proactive approach to learning early and developing an informed perspective for experiment design.

When I discovered that the research team didn’t have the bandwidth to support this, I trained my team to conduct and analyze the research.

Influencing strategy

I initiated design-led cross-functional workshops to inform quarterly and annual planning. Partnering with product leaders, I co-facilitated customer-centric sessions to identify our top hypotheses for upcoming quarters.

I also co-created workshops to envision future value propositions and revenue streams.

And I helped team members to build strategic influence, by helping them to create North Star prototypes, lead cross-functional workshops, and build cross-functional relationships.

Directing Projects

I begin advocating for my team early on – partnering with cross-functional peers on project strategy, scoping, and kickoff planning. I ensure that designers are setup to be strategic, research-informed, hypothesis-led.

I coach designers in problem-framing, exploring a range of solution approaches, and setting vision, design principles, and success metrics. I stay close to the work and participate in sketching, critiques, experiment planning, etc. We get qualitative feedback from customers on our designs. And I help designers to socialize their work and build interdisciplinary buy-in.

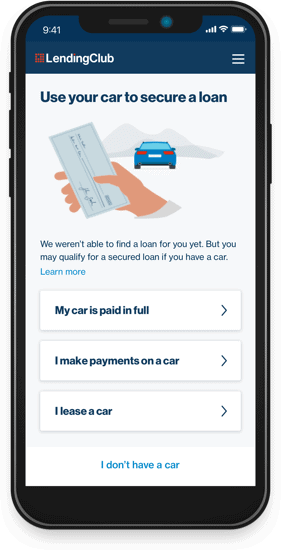

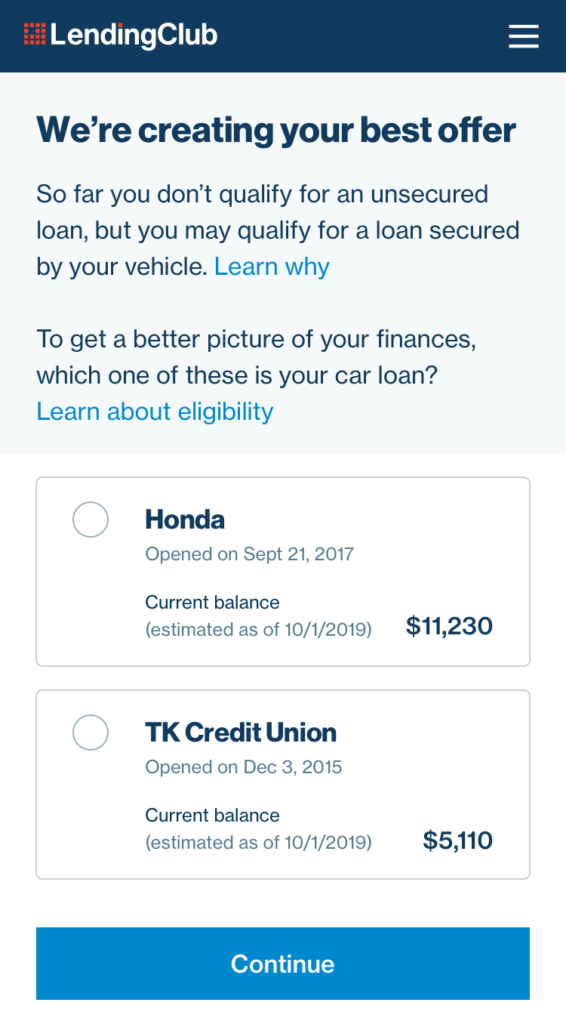

Launching new products

My team designed the experiences for new product offerings – including “Gap” loan insurance, and loans that are secured by automobiles.

Partnering closely with product, data, engineering and research teams, we launched MVPs to validate demand. Then we used experimentation and qualitative research to optimize conversion.

Designs by Karla D. and Lamar P.

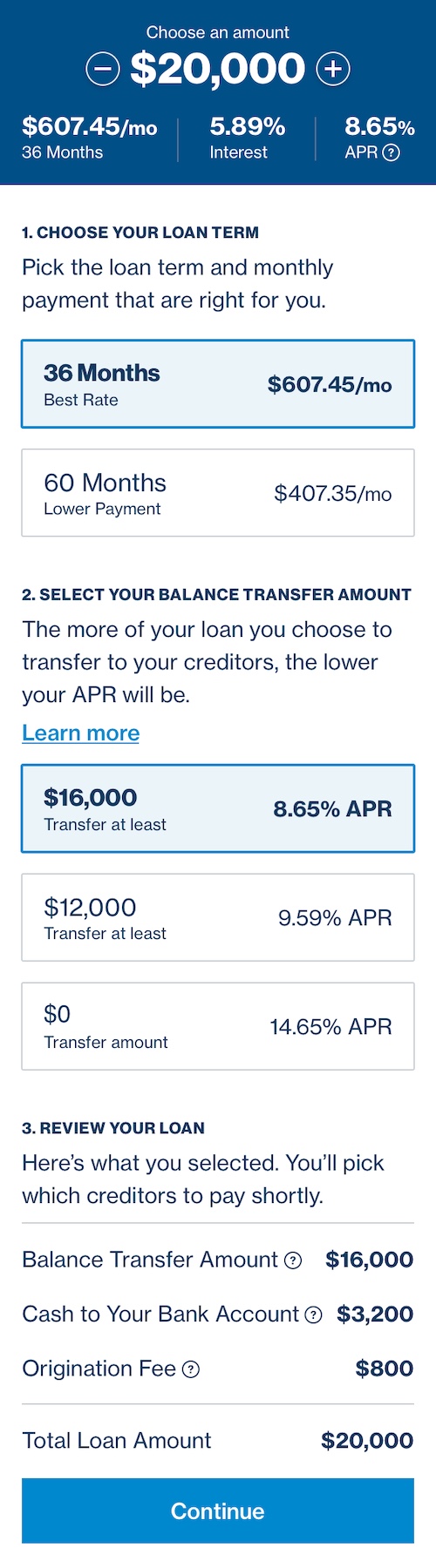

Envisioning scalable frameworks

Historically, LendingClub offered only one or two loan options to each customer. Loans were presented in a side-by-side table, which customers have found dense and difficult to understand.

The business wanted to introduce 3+ loan terms, and also wanted to raise the visibility of “balance transfer” discounts which provide a better rate for paying down debt.

We envisioned a scalable design which supports 3+ loan terms, and enables balance transfers, while still simplifying the experience compared to control. The modular approach empowers customers to build their own loan – choosing an amount, a term, and balance transfer amount.

This design out-performed control in qualitative tests that informed the experiment design. (Due to COVID-related loan throttling, we don’t yet have statistically significant performance metrics.)

Design by Sean I.

Gaining 50% lift in issuance

Based on funnel metrics and customer research, we saw an opportunity to improve the secured auto loan funnel through design.

Our redesign achieved a dramatic 50% lift in issuance by setting clear expectations upfront, reducing friction throughout, and providing transparency about all required information.

Design by Karla D.

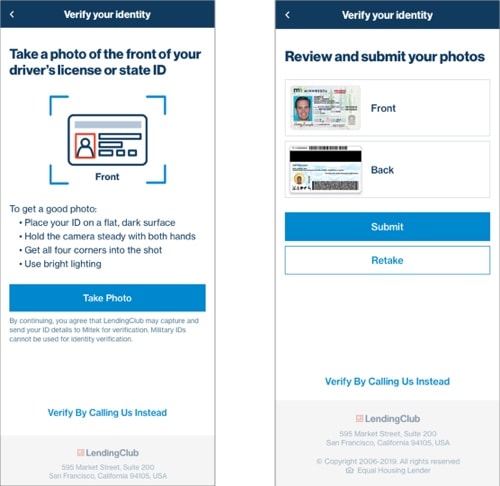

Simplifying complexity

We dramatically simplified the loan application experience by designing and launching mobile capture capability for documents. In addition, we reduced errors that require re-submission of document and reduced customer support time. Plus we boosted submission rate!

Design by Phillip L.

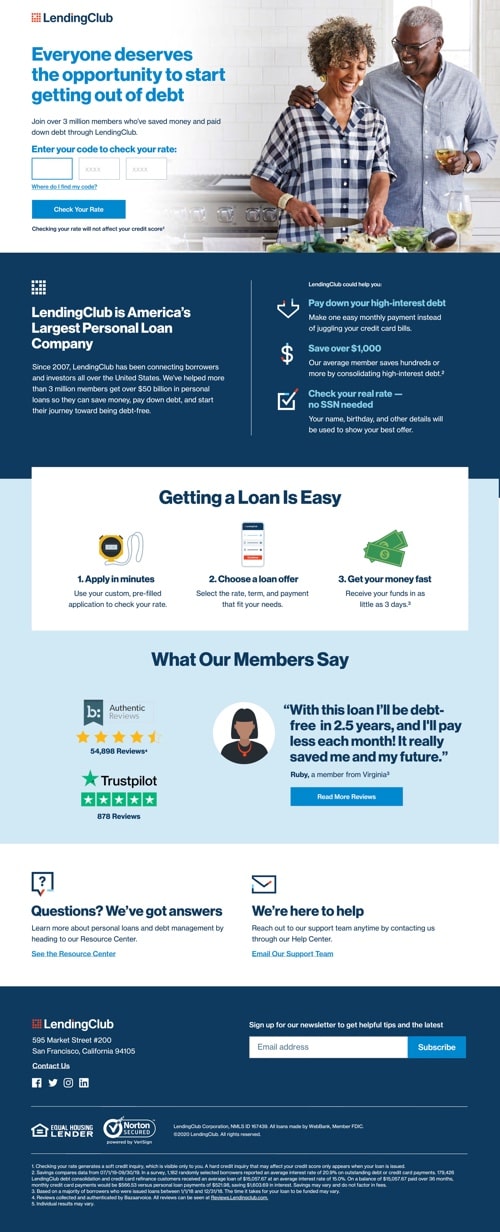

Creating cross-channel continuity

LendingClub invests heavily in direct mail marketing. Yet, the cross-channel experience going from paper invitation to digital application was not effective. My team redesigned the landing page, working in close coordination with the brand team who designed the direct mail.

The new experience provides consistency across channels – from benefits framing and nomenclature, to visual language and featured personas. We anticipate customer needs, questions, concerns. And we build trust by providing transparency, context, and social proof.

(Due to COVID-19, all direct mail advertising was paused, so we don’t yet have performance metrics.)

Design by Eric W.

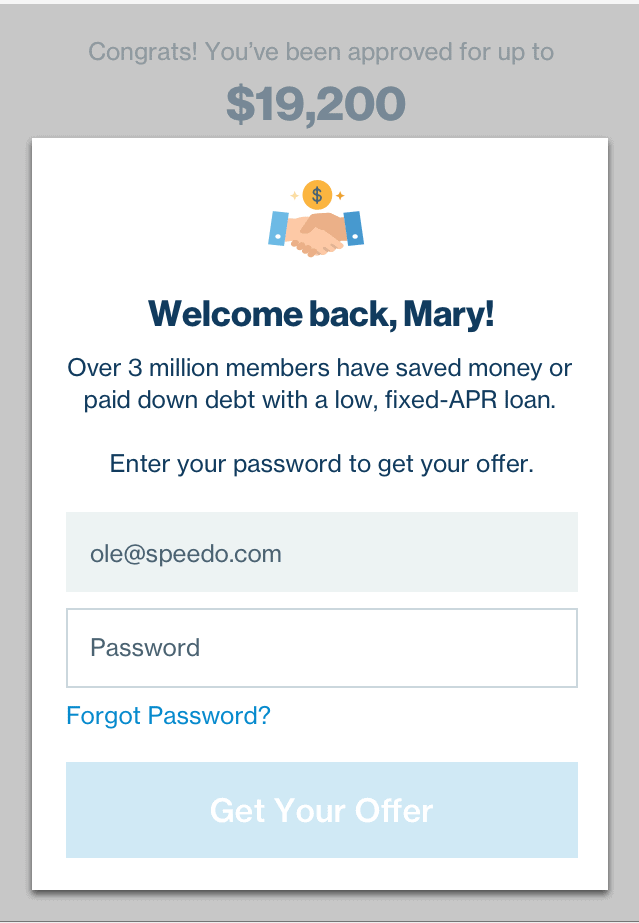

Growing acquisition

Over 50% of Lending Club’s loan traffic comes from partners like Credit Karma. Yet the experience of entering LendingClub from partner sites and getting a loan lacked cohesiveness.

We designed and tested 3 variants that streamlined the experience, present an offer upfront, reinforce LC security, and establish credibility through data facts. The winning variant has been productized and is on track to increase loan issuance by $100MM annually.

Design by Sharon L.

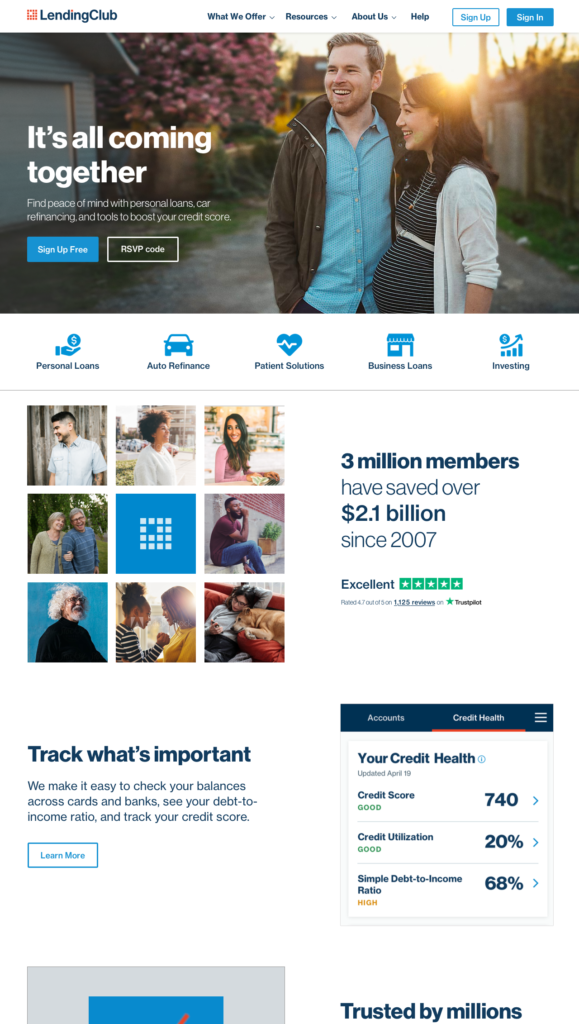

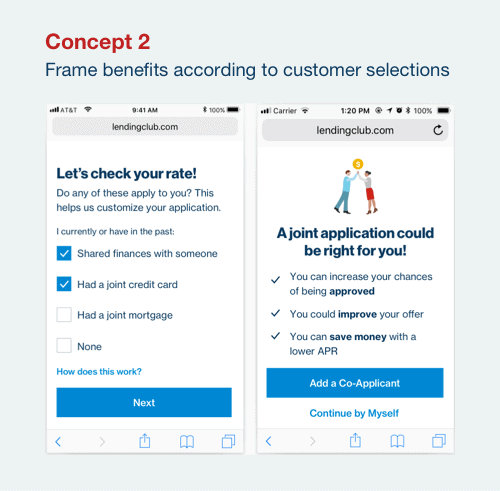

Reframing value props

My team redesigned the global navigation and homepage. We updated the visual language and shifted the value proposition from a one-stop loan to membership in a financial health marketplace. (This project was paused due to COVID before we finished the copy and design.)

Design by Eric W.

More projects

@ DAVE ERESIAN, 2018-2020