Driving innovation at BBVA

Design Director • 2015 – 2018

As Design Director at BBVA, I led teams that reimagined banking experiences for consumers and small businesses, helped to create new Fintech businesses, and grew teams in Latin America.

BBVA is a global bank with 56 million customers and the “world’s best banking app” (Forrester Research).

Leading teams

I co-led the UX design practice in San Francisco and managed a team of 6 product and content designers.

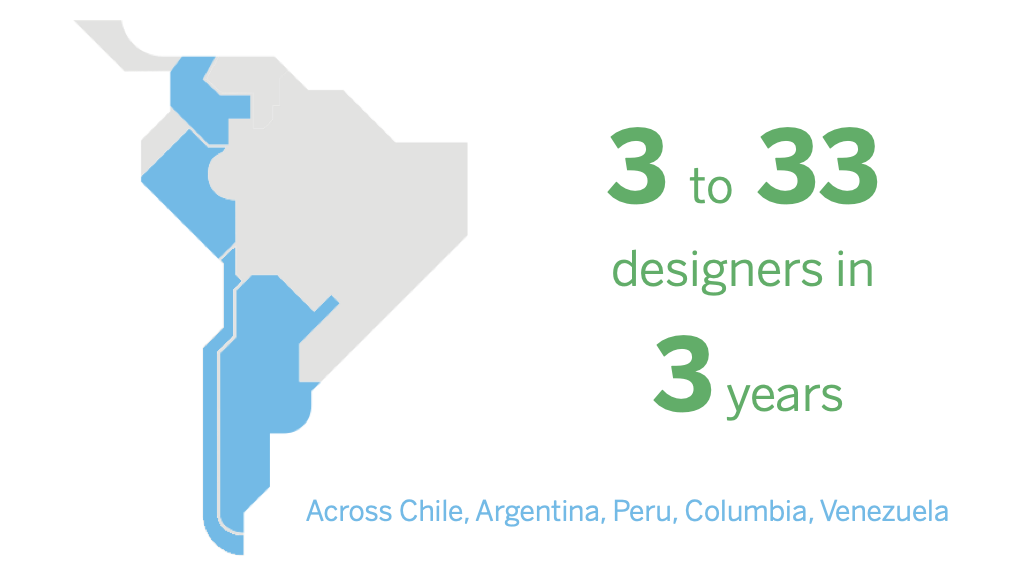

Scaling teams in Latin America

I helped to build and train a first-time design team in South America. I recruited and helped to hire the first designers at BBVA-owned banks in Argentina and Peru. During my tenure, the initial hires were promoted to managers, and the South American internal design teams grew from 3 to 33 designers.

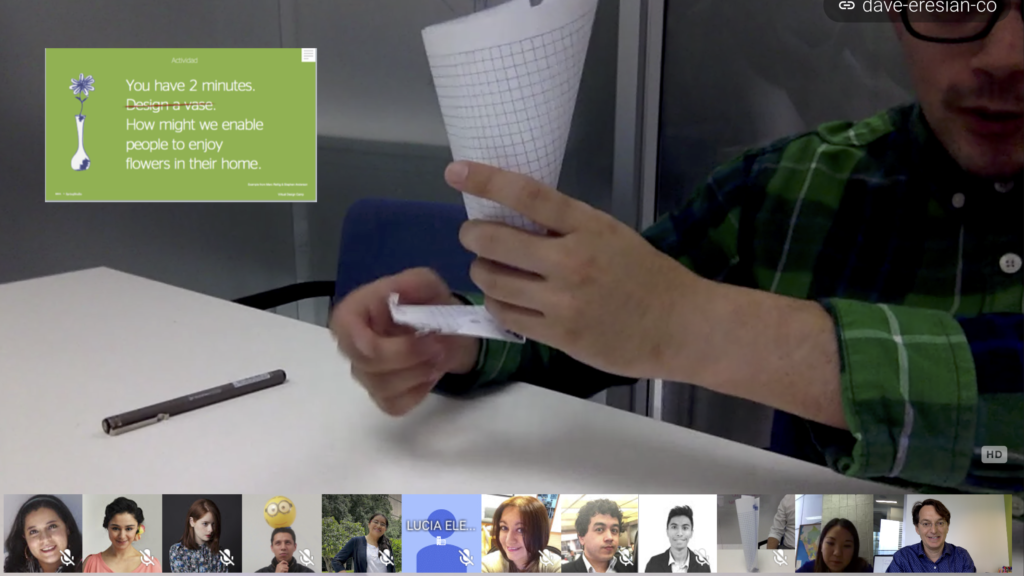

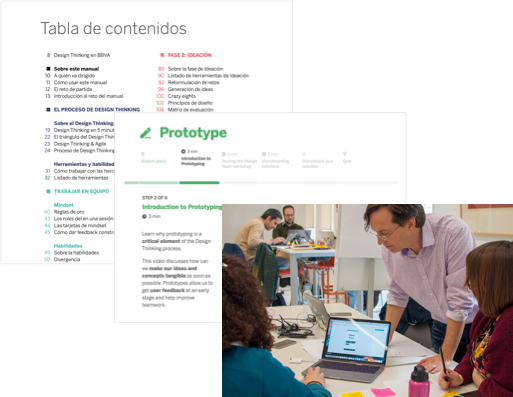

Training dozens of designers

I spearheaded the development of a design curriculum and training materials, and led a weekly webinar series for dozens of designers across Latin America.

Design Transformation for NON-designers

I was a key contributor to BBVA’s Design Transformation program, which has trained over 1000 non-designers in design thinking. The program highlights each employee’s link to customers, and provides tools to enhance collaboration and creativity.

I created and taught a 3-day master class in Madrid on Prototype Thinking, and contributed to BBVA’s 150+ page Design Thinking manual and online course materials.

Championing creative culture

I led design practice meetings, company culture retrospectives, initiated critique, cross-functional workshopping, service design prototyping, and an internal blog.

Reimagining Banking

My team envisioned new consumer and small business products and features, and designed new BBVA-backed startups.

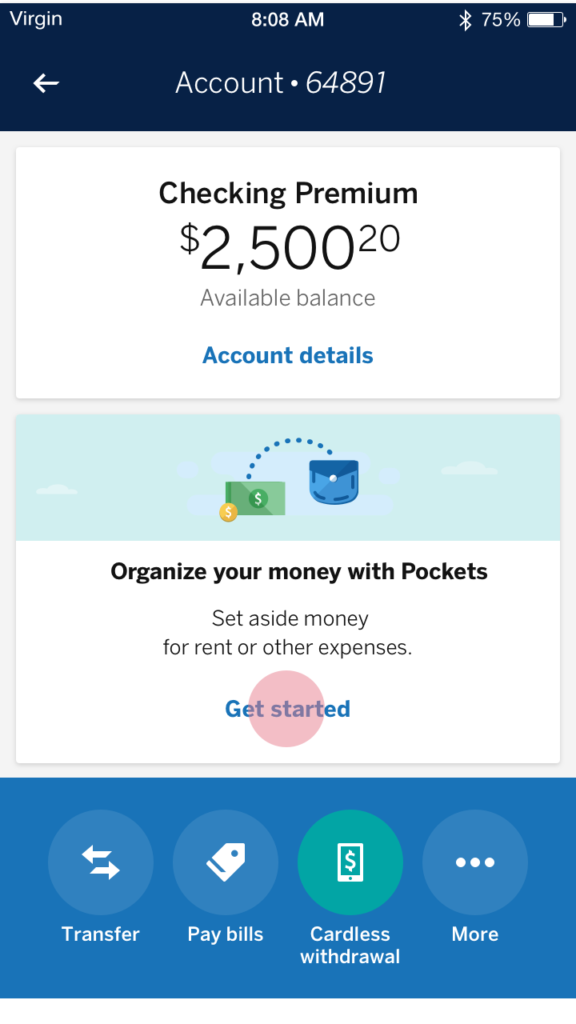

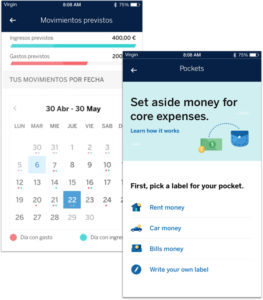

Creating a differentiated offer

I led an initiative to envision a differentiated value proposition for direct-deposit customers in Latin America.

Based on insights from my team’s customer research, we created a suite of new features and financial products that are successfully attracting, engaging and retaining customers.

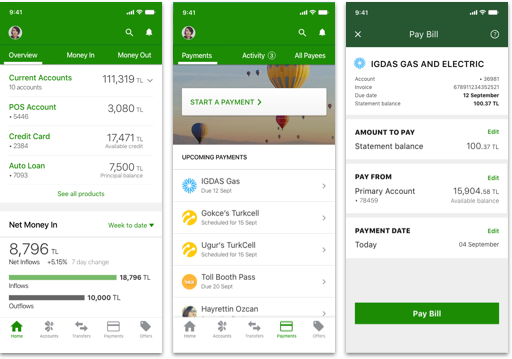

Creating a first-time platform

I led an international team in the design of a first-time small business banking platform for BBVA Garanti bank, the second largest private bank in Turkey with 12 million customers.

Based on insights from our research, we envisioned, designed and launched a new platform that provides small businesses with an insights dashboard, and dramatically improved experience for payments, transfers and accounts management.

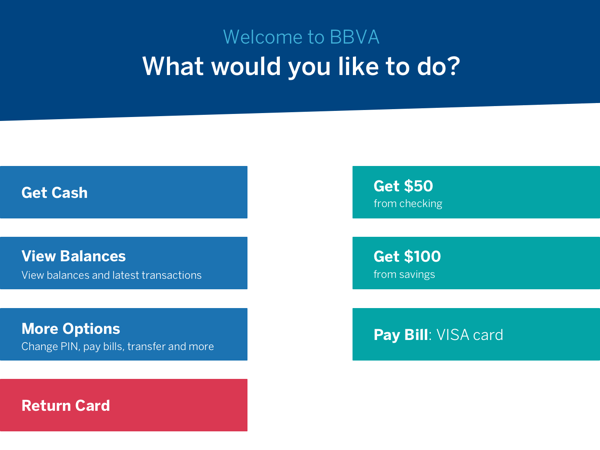

Redesigning the ATM experience

I led the redesign of BBVA’s ATM experience for Latin America. We rebranded the experience, improved the perception of security, and dramatically streamlined key interactions – e.g. 1 tap for withdrawing cash (down from 6 taps).

Our design needed to work within the limits of 8 button ATM machines, as well as newer touch-enabled machines. My team helped to extend the nascent brand guidelines, which until then had accounted only for web and mobile devices.

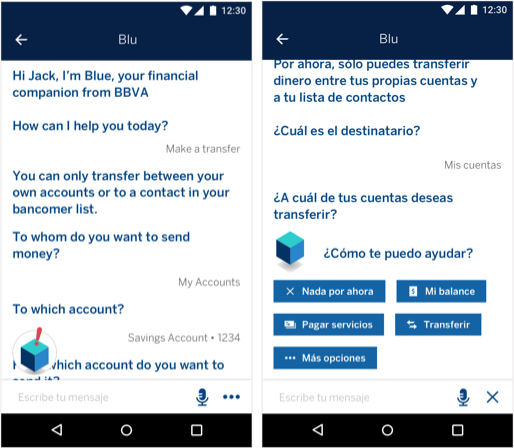

Envisioning a Smart Assistant

Our team envisioned and prototyped BBVA’s first AI-based assistant, Blue.

Design by Jorge M.

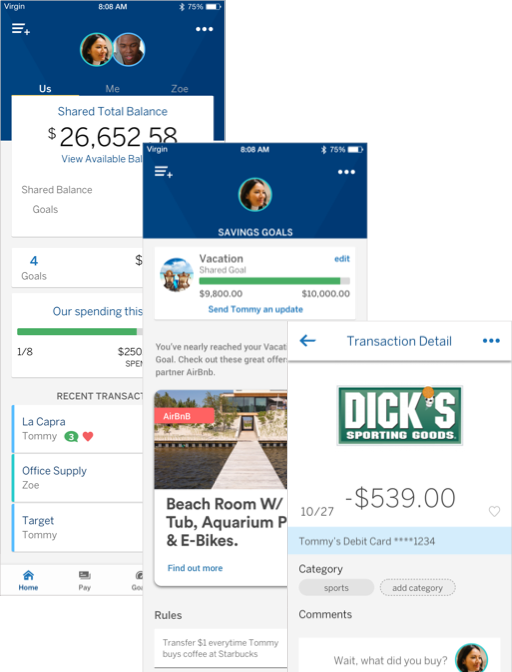

Envisioning Shared Accounts

My team envisioned designed and prototyped this concept for shared account management, goal setting, and communication around finances.

Design by Linda M.

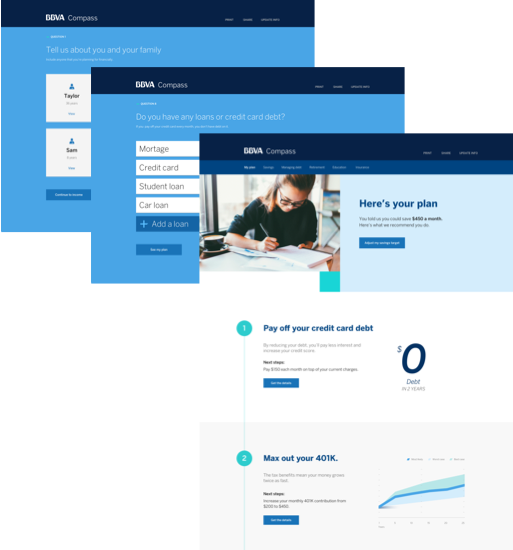

Financial planning for everyone

This product concept makes it easy to create an actionable plan for meeting long-term financial needs like insurance, education, retirement and more. Plans are dynamically adjusted based on live monthly income and spending data.

Design by Linda M.

Envisioning and launching new startup ventures

In partnership with BBVA’s New Digital Businesses group, my team led strategy and design for Fintech businesses incubated and spun-out by BBVA.

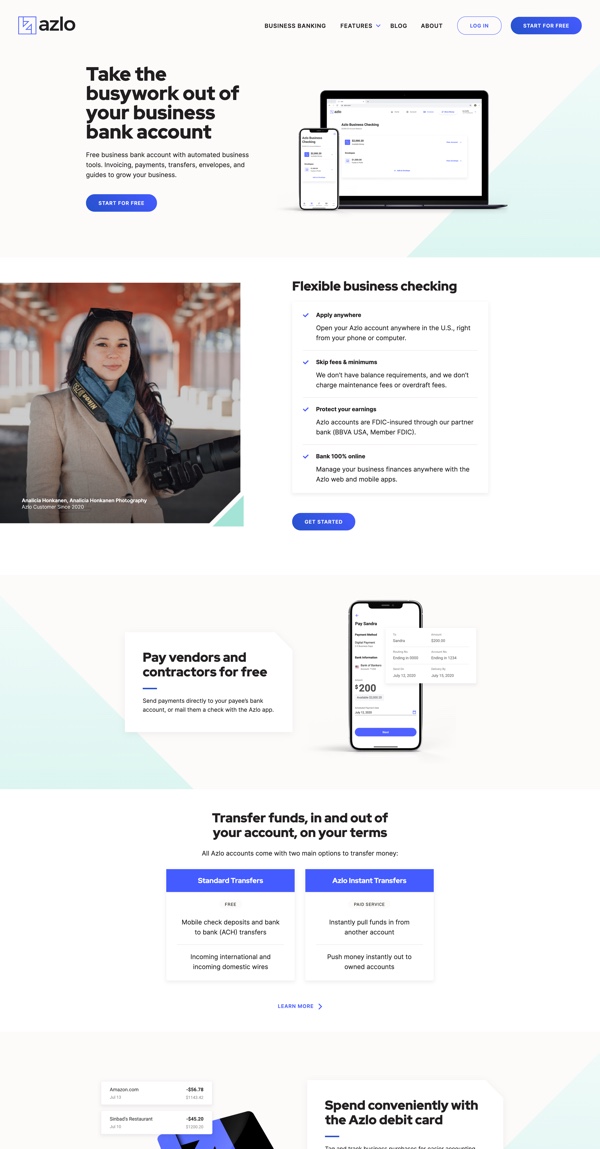

Azlo: Small business banking

Partnering closely with the BBVA’s NDB Entrepreneur in Residence, my team led design from initial concept thru research and MVP.

“Azlo is the first digital banking platform offering fee free business accounts with unlimited payments to anyone in the US and including bill pay and basic digital invoicing in the baseline product. With a business debit card, an unlimited number of mobile check deposits and free national ATM access, Azlo is the most simple, affordable way for entrepreneurs and business owners to go borderless and grow their passion without all the headaches and hassles of traditional banking.”

Application conceptual design and wireframe design by Nick O.

Denizen: Borderless banking

Partnering closely with the BBVA’s NDB Entrepreneur in Residence, my team led design from initial concept thru research and MVP.

Denizen launched in March 2018 as a global account service that allowed expats, international travelers and immigrants access various banking and money transfer functions at lower cost.

More projects

@ DAVE ERESIAN, 2018-2020